Spring Clean Your Estate Plan

Now is a great time to look over your estate plan and make sure everything is up-to-date and current.

Here are 5 things to go over to make sure your Estate Planning is accurate:

#1 UPDATE YOUR BENEFICIARIES:

Make sure your beneficiaries are current in your Trust. Relationships can change. Divorce, separation and death can impact your beneficiaries. Or maybe a marriage, birth or adoption have added some extra relationships in your life that you have not yet accounted for.

And if you need to update your beneficiaries in your trust you can read about updates and amendments here or contact us at: [email protected].

#2 HAVE YOU MOVED OR BOUGHT A NEW PROPERTY?

Transferring property into the name of your Trust is one of the most important steps in funding your Trust. To transfer property into your Trust, you must record a deed at the county recorder's office where the property is located. This deed includes the legal description of the property and must match the county records exactly. If the deed is not recorded correctly, your property may be subject to probate - and let's be honest - that is what we are trying to avoid!

You can learn more here about transferring existing property, purchasing new property or refinancing property.

#3 ARE THERE ANY CHANGES TO YOUR FAMILY THAT WOULD AFFECT GUARDIANSHIP DESIGNATIONS?

Have you had any children? Adopted a child? Are your children grown past the age they would require a guardian? Some of these changes are already accounted for in your Revocable Living Trust, but it is important to make sure that your guardianship designations are current. You can learn more about Planning for your Minor Children here.

#4 HAVE YOU ACQUIRED ANY NEW POLICIES, BANK ACCOUNTS OR OTHER ASSETS?

Funding your Trust (transferring your assets into the name of your Trust) is the MOST IMPORTANT PART of having a Trust. Your Trust must be funded with assets in order for it to operate properly. Schedule A (included in your Trust documents) is used to help you create an inventory of assets to be included in your Trust. Listing your assets in Schedule A is not enough! In order to avoid probate, you must contact each financial institution individually and follow the instructions we provide to move your assets into the name of your Trust. Each type of asset requires a different process so please follow the instructions carefully. You can learn more here about Funding your Trust.

#5 ANY CHANGES THAT WOULD AFFECT YOUR FINANCIAL OR MEDICAL POWER OF ATTORNEY?

Is the person you designated as your Financial Power of Attorney or Medical Power of Attorney still willing and able to act on your behalf? Make sure you've talked with them about this responsibility and update it if necessary. You can learn more here about "What Happens if I Become Incapacitated?

We hope these tips help you spring clean your Estate Plan this year!

The importance of estate planning in S-town (and every town)

If you are one of the 40 million people that have downloaded and binge-listened to the S-Town podcast (from the creators of Serial and This American Life) then dying without an estate plan has been on your mind.

WARNING: S-TOWN SPOILERS AHEAD! (If you haven't listened to the buzz-worthy podcast yet and don't want any spoilers then stop reading now and come back later! Please also note that S-Town contains explicit language)

Among the many heartbreaking aspects of S-Town is the fallout of what happens when someone dies without making their wishes legally known. The podcast twists and turns leaving a tangled mess in the wake of the unexpected death of John B McLemore. A mother left behind with dementia and no legal guardianship in place, rumored hidden gold, 13 beloved dogs, acres of property with a complex hedge maze, a specialized shop full of tools and a myriad of other items are all left in the lurch. All the resulting confusion, chaos, legal issues and pending felony charges between family and friends of the deceased could have been avoided with a simple estate plan.

Knowing how easy (and affordable) it is to create a proper estate plan with our company Easy Legal Planning made listening to S-Town painful. The fighting, lies and subsequent finger-pointing that unfortunately often happen are completely avoidable when you take the time to legally make your wishes known. And knowing that John B's wishes were not carried-out made my heartache. A simple text with your wishes is meaningless in probate court. If only John B had actually followed-through with some estate planning the story would certainly have had a less frustrating - although no less heartbreaking - ending.

In the podcast it sounded like John B was close to finalizing some estate planning but never followed-through with creating his will. This would have been a helpful document that would have taken effect after his death. But there is another document that takes effect in an individuals lifetime that would have been very helpful and would have avoided the probate process entirely. A Revocable Living Trust is just what the name implies, a document that is created during an individual or a couple’s life, but that can be changed or terminated at any time. A Trust allows you to decide who will receive your assets, how much they will receive, and when they receive it. A Trust allows you to choose your successor trustees, who your beneficiaries are and appoint guardians for any minor children.

If a Revocable Living Trust is set up correctly (and all of the property and assets are properly transferred to the trust while you’re alive), it will provide the following benefits: Avoid probate entirely; distribute property and assets to the beneficiaries almost immediately; ensure any minor or disabled children are cared for; handle financial affairs if someone becomes incompetent; and save money in federal estate tax and capital gains taxes.

Many of the injustices I felt in the podcast were completely avoidable. In our business we have heard of many similar situations happening and we love being able to help families avoid situations just like these with proper estate planning.

For less than the cost of one of John B McLemore's "charity" tattoo sessions you can purchase our Revocable Living Trust Package (Learn the difference between wills and trusts here). Do it for yourself or your loved ones and avoid the fighting and finger-pointing that almost always accompany death with no estate plan in place. You can get started HERE.

John B McLemore's incredible hedge-maze has 64 possible outcomes and one null-set. The maze is currently in disrepair and ruin which could also have been avoided with proper planning.

You don't have to leave your estate (or the estate of your loved ones) with as many possible "outcomes" as John B's hedge maze. You can create a simple solution to avoid any estate planning issues by creating a will or trust and make your wishes legally known. The process is actually very simple and affordable...trust us you'll be surprised. By answering the five questions in our video below you can easily get started on your estate plan today:

If you are interested in learning more about estate planning and find out why a revocable living trust would have been a great option for John B McLemore visit us at Easy Legal Planning.

Dirty Dozen: 12 excuses to procrastinate estate planning

55% of Americans avoid estate planning and set their family up for stress in the future. Here are 12 common excuses to procrastinate estate planning.

Over the past few days, the local news has been filled with tragic accidents that have claimed the lives of young parents. From winter-related freeway fatalities to a small plane crash, each report makes me wonder if the families left behind have been protected with proper financial resources and estate planning. Sadly, most families are not. Last year a survey by Harris Poll conducted for Rocket Lawyer found that 64% of American adults do not have a will and 55% do not have any estate planning in place. Around 50% of those people indicated that they didn't need one or just hadn't gotten around to it. Excuses abound when considering estate planning, but the reality is that 100% of us are going to die at some point, we just don't know when. Estate planning, when paired with a proper financial plan, protects us (and our families) from the unknown and gives us peace of mind.

Here are some of the common excuses to procrastinate estate planning. If you see yourself in these excuses, it is time to do something about it.

1. I’m too young. You are never too young to have an estate plan. Young adults need an estate plan to provide financial and medical power of attorney responsibilities. At 18, mom and dad can no longer legally step in. Young families need estate planning to provide guardianship and asset management/distribution for minor children. Just bought your first house? Put it in a trust to avoid probate issues. Finally have life insurance? Use a trust to avoid your kids getting the pay off at 18. It is never too early to have an estate plan and a good estate plan that is regularly updated will last a lifetime.

2. I don’t have enough money or assets. Whether you are worth $10,000 or $5 million, estate planning issues and conflicts are the same. (Often they are worse with a smaller estate). If you own a home and/or have life insurance, both will be sizeable assets that need to be distributed. Real estate will likely go through probate if not properly titled in a trust. Boiled down, estate planning is just a fancy way of saying what happens to your stuff (house, assets, kids) when you pass away and who is responsible to make it happen. Everyone needs help with that. Everyone. Doing nothing just causes problems in the long run.

3. I’m married. It’s common to think that your spouse will take care of everything when you are gone. However, when a spouse dies the surviving spouse is left to deal with many loose ends. On top of mourning and grief, managing finances and assets can be overwhelming. Does your spouse know where all of the assets are located? How will they know where to start? A good estate plan will list assets and financial institutions to act as a guide to help the surviving spouse sort everything out. If you need a not-so-good example, read this post.

4. I’m single. If something happened to you today, what would happen? If you are incapacitated, who would keep paying your bills while you recover? Who would make medical decisions for you? Legally your parents are no longer allowed to step in – and would you want them to? If you suddenly died, who knows where you bank and how to access your accounts? Who knows where you have life insurance? Who could settle your estate – and yes, you have an estate. Single people often need an estate plan even more than married people because there isn’t an automatic person who can step in and take over.

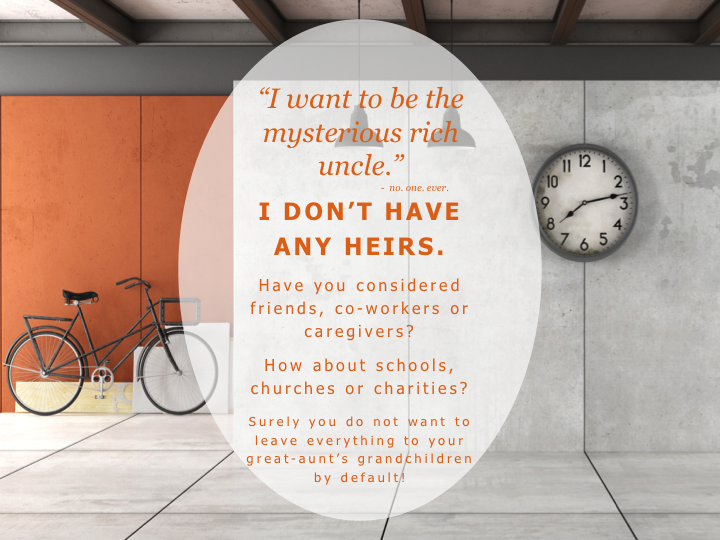

5. I don’t have any heirs. If you are in a situation where you do not have any children, siblings or other close family members, you should have an estate plan in place. This provides an opportunity to look outside the normal family parameters and show how much you care for others in your life. Consider friends, co-workers, care-givers or look to schools, churches or charitable organizations that support your values. Without an estate plan in place, your assets could end up going to your great-aunt’s grandchildren that you have never met. While we all wish for that mysterious rich uncle to miraculously appear, do you really want to be the mysterious rich uncle?

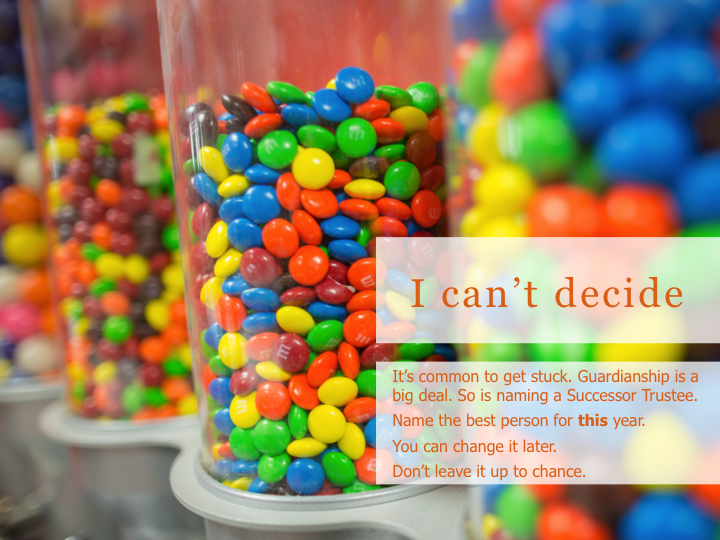

6. I can’t decide. Most of our clients come to a point in their estate planning where they get stuck. Most often it is regarding guardianship for minor children, but sometimes it concerns Successor Trustees or Power of Attorney responsibilities. The best decision is to make a decision. Who is the best fit this year? It can always be changed in the future. It’s better that you make a decision than leave it up to chance.

7. I have a will. A will on it’s own is helpful in determining an executor for the estate, guardianship for minor children and distributing assets. The downside to a will is that it will go through the time consuming and expensive probate process. In addition, minor children will receive all assets at age 18. Depending on how responsible your beneficiaries are, this could be a recipe for disaster.

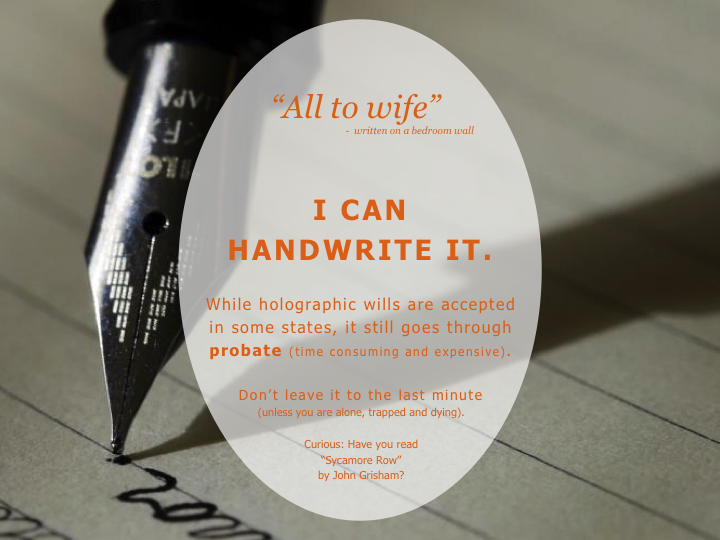

8. I can handwrite it. Some states recognize holographic (handwritten) wills and provided they meet minimum requirements, allow the will to be probated. Holographic wills are not recommended, but are often created in emergency situations when a testator is alone, trapped and near death. Yes, you can handwrite it, but it may not be best to leave it to the last minute and it will still go through probate.

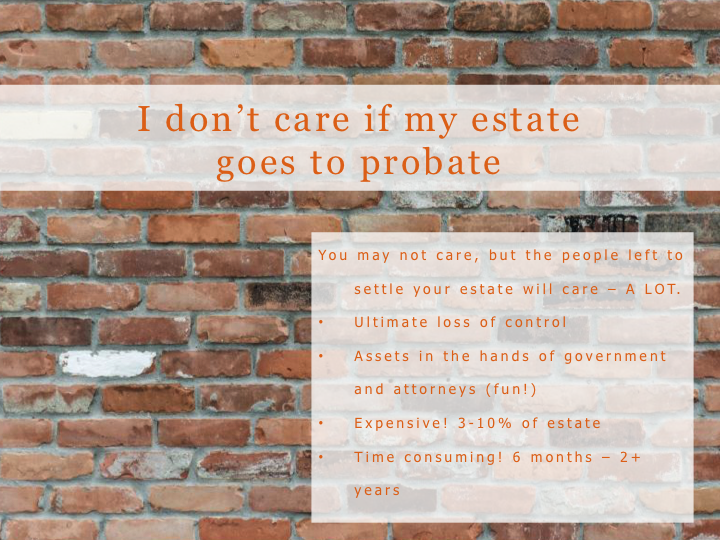

9. I don’t care if my estate goes to probate. You may not care if your estate goes to probate, but the people left to settle your affairs will care – a lot! Probate is the ultimate loss of control. Your assets end up in the hands of the government and attorneys. Sound fun? In addition, probate is expensive and time consuming, taking anywhere from 6 months to several years and costing 3-10% of the total estate value.

10. I need a lawyer. Did you know that estate planning documents are template based and are completed by “filling in the blank” with a little customization? If you have a straightforward financial situation and simply need to get your assets to the right people in the most efficient way possible, you can bypass an attorney and look at other alternatives. The paperwork is exactly the same. As long as it is notarized and witnessed in the correct places, you will have the same legal documents that an attorney would prepare. Easy Legal Planning provides comprehensive, state-specific estate planning documents with specific instructions to assist you in making the documents legal and in funding your trust. It is a great fit for the majority of people. However, there are some situations that benefit from having a local attorney to assist with an estate plan. If you feel your estate plan is overly complicated, consult a local attorney.

11. It’s expensive. Estate planning can be expensive. When prepared by an attorney, a comprehensive estate plan that includes a living trust averages between $1500-$3500 and goes up from there. That is a lot of money for a suite of documents that are relatively “fill in the blank” and template-based. Online DIY alternatives are much less expensive but offer very little assistance when you have questions and are automated to spit out exactly what you put in – whether it is right or wrong. Easy Legal Planning offers a hybrid experience with live assistance available to answer questions and explain the documents included in your estate planning package. Estate plans that include a living trust are a fraction of the cost of an attorney and include real people preparing your documents.

12. I already have an estate plan. This may be the most plausible excuse, but before you pat yourself on the back, think about the last time you looked at your estate plan. There are two issues you need to address regularly: people and assets. It is possible that the people you named in your documents may not be the best fit for their responsibilities. Death, disability, divorce and life circumstances may mean you need to make some changes. Review your assets and make sure your trust is properly funded. Over time as you add new assets, you may forget to include them in your trust. Make sure real estate is titled in the name of your trust and accounts have the correct beneficiary designations. Before you think you are in the clear, take a look at your documents and make sure everything is up to date and funded properly.

You don't have to look far to see examples of people and families who needed a proper financial and estate plan. Excuses and procrastination are easy, but devastating when emergencies occur. Consult a financial professional to make sure your family is prepared for the future and pair your financial plan with an estate plan that will take care of you no matter what life throws at you. Easy Legal Planning is the easy way to get eliminate excuses and procrastination when it comes to estate planning.

When a spouse dies without estate planning (or any planning), what do you do?

"She believes he had a small investment account somewhere and he also may have had a small life insurance policy, but we just don't know. She has no clue what, where or anything."

When a spouse dies, many of us comfort and assist the survivor through grief and pain, spending time and ensuring the survivor knows they are loved. We may overlook the financial impact of the death, simply assuming the surviving spouse will boldly continue on and maintain the standard of living that the couple has always enjoyed. Often this is not the reality for a surviving spouse. Under normal circumstances finances are a stress and without proper planning, this stress can be needlessly heightened. Recently I received a painful reminder of how difficult this transition can be:

Got a question if you can help. One of my agents passed away in October. I just spoke to his wife and unfortunately, he had nothing set up to let her know what assets he had and where they were located. I am wondering if you know how does a spouse start to find out where he had money.

She believes he had a small investment account somewhere and he also may have had a small life insurance policy, but we just don't know. She has no clue what, where or anything.

Any ideas? She went to someone for "legal aid" and the price they quoted was much more than she could afford. It's a pretty bad situation...

Thus, the power of proper planning... any ideas would be greatly appreciated. I would like to offer her some help as she is just not versed in these matters.

When a spouse passes away without any planning in place, what do you do? How do you find the lost insurance polices or retirement accounts? Unfortunately in your time of grief you will need to play detective and find the financial institutions where your spouse may have placed money. Here are a few tips:

- Contact any family members or friends the spouse may have confided in and ask if he/she mentioned any financial institutions

- Contact your attorney, banker, accountant and financial planner

- Contact your insurance agent - often life insurance is bundled with auto and homeowners policies

- Look at canceled checks and print monthly bank/credit card statements to see if there are automatic withdrawals/deposits to financial institutions

- Watch the mail for paper statements

- Make a list of current and prior employers and contact HR departments to find out about group life insurance and where retirement accounts are held

Financial institutions are not obligated to inform you of accounts or policies, even if you are the spouse. Typically they will not act until someone notifies them of the death and issues a proper claim. It is up to you to track down the companies where your spouse may have had assets. It is a time consuming and difficult process that may take months and even years.

This devastating situation can easily be avoided by simply having proper planning in place. Estate planning is often thought of after the death of BOTH spouses, but a proper plan can help the surviving spouse avoid this messy situation altogether.

What can you do now, to avoid a situation like this in the future?

- TALK TO YOUR SPOUSE There is no better way to avoid this situation than by simply having a conversation. Confide in each other and make sure you are both aware of the accounts and policies you own and where they are located.

- WRITE IT DOWN If talking isn't your thing and even if it is, make a list and keep it in a place where it can be found. Be comprehensive and specific, detailing accounts, policies, financial institutions and representatives.

- UPDATE A list you wrote in 1994 is only as effective as your loyalty. If you change companies, update your list. Rule of thumb, look at the list each year on January 1st, your birthday or anniversary.

- COMPLETE YOUR ESTATE PLAN Easy Legal Planning offers comprehensive estate planning packages for $595.00 that include a trust, pour-over will, financial and medical powers of attorney and medical directives. In addition, we include a comprehensive section for you to list your assets and financial institutions, instructions for those left behind and we remind you to keep it updated on an annual basis. (How's that for service?!)

Losing a loved one is devastating in itself, but compounding that pain by not having a clear financial picture is a needless waste. Take action today to avoid playing detective while trying to manage grief. Have the conversation, write the details down and complete your estate plan. Your loved ones will thank you now and in the future.

4 Awkward Holiday Dinner Conversations

Holiday dinner: Never discuss religion, politics and... estate planning?

Wrong! While the conversation is difficult, it is extremely important to talk about estate planning. A recent client gathered his family and told them of his estate planning decisions. He was surprised when several children balked at the jobs he assigned them. "I don't want to make the medical decisions - Jane would do a better job!" "Why isn't Bob handling the finances, he is good at that sort of thing?" He reorganized his documents and the family was much more comfortable and supportive. Many people default estate planning assignments to the oldest child, but sometimes that isn't the best fit. A conversation with your loved ones can help clarify the responsibilities and get everyone on the same page. If you need help, here are 4 Holiday Conversation Starters, they are bound to generate interest and a lively debate. When all of you are sufficiently full and concerned for your estate planning, schedule an appointment using our online calendar and get the problems solved! Now... can you please pass the stuffing?

#1 Money, Money, Money

If you are unable to make financial decisions, who will step in and manage your accounts? Are you comfortable with the first person to volunteer as your Durable (Financial) Power of Attorney taking over your checkbook? Will they keep the bills paid and the lights on in your home until you are able to return or will they see a chance to dip into their inheritance early? Further, who will settle your estate as the executor or successor trustee when you die? Be careful with this decision as some people tend to get power (and money) hungry. We have had many phone calls from siblings whose sister/brother have commandeered the home/car/money because they have been designated the point person for distributing the estate. There are laws against that, but the integrity of the person is your first defense. Talk with your loved ones and get a feel for who will do a good job and keep the peace. As a side note, with regards to your personal items, put the post-it notes away and use this awesome book we recommend for divvying out the "stuff" left behind in a home. "Don't let the stuff you leave behind destroy your family" is a game changer! Order a copy today and have family peace tomorrow.

#2 Medical Decisions

To pull the plug or not to pull the plug - that is the question. Who will make that decision? Have you informed that person that they're responsible to make decisions when you are incapacitated and for your end of life care? As your Medical Power of Attorney, do they have any idea what you want and how you feel about the situation? Do yourself (and the responsible party) a favor and TALK about it NOW. Complete your medical directive and then clarify your thoughts. Your family will be much more comfortable making difficult decisions for you, if they know what you truly want. Having your decisions in a formal, legal document will also avoid family conflict if there are disagreements for your care.

#3 Probate

This is a crucial conversation to have with anyone, but especially your aging parents. Without a revocable living trust, their home will likely go to probate. This is expensive and time consuming. In addition, there are capital gains taxes to consider. By having a trust in place, the home stays out of probate and gets a step-up in basis when the owners die - thus protecting the beneficiaries from the time and expense of probate and a large tax bill. If there is any kind of real estate involved, even if it is mortgaged, a trust is critical... trust us!

#4 Kids

Ever the emotional topic, when things get dull at dinner ask, "Who will take care of the kids if we aren't around?" Do you hear crickets or are your sisters clamoring to be first in line? Is the first volunteer, your first choice? A client recently called and wanted to get his estate planning completed immediately for this very reason. He was at a funeral and his sister came up to him and said, "If anything ever happens to you, I will take care of your kids". She was the last person he wanted his kids to live with, so he quickly completed his estate planning to ensure that would not happen. So, do you really want your crazy sister stepping in, when your friend is a much better fit? Probably ought to get that guardianship figured out.

These conversations aren't easy, but they are very important. Take a few minutes this holiday season to talk about more than the weather and the dry turkey. You and your loved ones will be glad you did!

Ready to get started? Schedule an appointment today.

5 tips to help parents financially survive college

Parents know that college is an expensive undertaking. Here are 5 tips to protect parents and help them survive the college years.

It's that time of year again and families around the country are preparing for college. With in-state public university tuitions averaging around $20,000/year and private university tuitions averaging near $45,000/year, college is a big financial commitment. Here are a few tips to help parents financially survive college:

AUTO INSURANCE

Check your insurance policy and make necessary adjustments. Make sure your student's car is covered under your policy or their own.

Liability protection: This is not something to skimp on - get the maximum. Your child may not have a high net worth, but what about the person they hit and injure in an accident? Attorneys and insurance companies consider "human life value" when determining an appropriate claim payout. For example: your student is responsible for an accident that severely injures (or kills) a 40 year old professor who makes $80,000/year. The professor's human life value is around $2 million (# of years left to work x salary). The attorneys will go after that amount and the insurance companies can't argue. How far will your $50,000 liability coverage get you? Not far. You and/or your student will then have to find a way to pay the difference between your liability coverage and the claim. Emptying 401Ks, home equity, wage garnishment - none of that sounds good. Instead, adjust your liability to the maximum and add an umbrella (liability) policy.

Under/Uninsured Liability protection: Don't forget about your student - what if they are hit by an under or uninsured driver? Make sure you and your child are protected by adjusting those liability limits to the maximum as well.

Property damage: Update the coverage on the property damage. Your student may be driving a beater, but that doesn't mean they can't run into, and total, a Lexus.

Typically by raising your deductible, you can add higher liability coverages and add an umbrella policy without affecting your premium. Talk to your agent for more details.

RENTER'S INSURANCE

Laptops, TVs, tablets, Blu-Ray players, gaming systems, cellphones and other devices are packed in with all the other college gear. These big ticket items are prone to be stolen and are expensive to replace. In a recent survey, 48% of parents worry about these replacement costs.

Check your homeowner's policy to verify your coverage and consider renter's insurance for your student. Have your child video their college home to create an inventory of their belongings. Talk to your agent for more details.

HEALTH INSURANCE

College brings a new exercise and eating regimen to your student. Eating on the run, from a machine or a cafeteria, and pulling all-nighters tends to put your child at risk for getting sick. Under ObamaCare, your child can stay on your health insurance until the age of 26. However, that doesn't ease the stress of having a sick child far from home. Here are a few tips for students and parents when a child gets sick.

COMPLETE YOUR STUDENT'S FINANCIAL AND MEDICAL POWER OF ATTORNEY

At 18, a student becomes a legal adult and a parent's ability to help in a medical emergency is limited. HIPAA laws protect your child's privacy, but also prevent you from assisting or even getting information in the event of an emergency. Talk to your child and set up a financial and medical power of attorney, so that you can care for your child in an emergency. Remember, the power of attorney is only in the event your child cannot care for him/herself. Contact Easy Legal Planning for help.

LIFE INSURANCE

In a recent survey, 39% of parents reported they may not have enough life insurance coverage to pay for 4 years of college. Review your life insurance policies and ensure that you have enough coverage to send your child to college, even if you aren't around. You may also consider a policy on your student. If your child passes away before college loans are paid for, a life insurance benefit would be a huge help. Talk to your agent for more details.

College is an exciting time in your student's life. With just a few preventative measures, you can sit back and survive, if not enjoy, this time too.